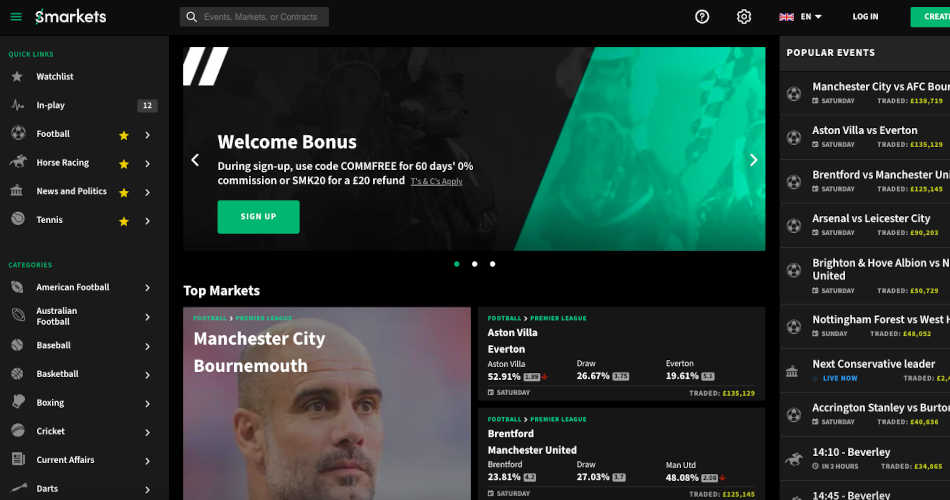

The UK Gambling Commission (UKGC) has fined operator Smarkets after discovering several failings.

Smarkets (Malta) Limited, which operates betting exchange Smarkets, has been fined £630,000 by the Commission after the firm conducted an investigation into the operator and discovered a series of anti-money laundering and social responsibility failures.

According to the Commission, one of the failings uncovered by the Commission included allowing one customer to deposit £395,000 over a four-month period without carrying out the appropriate source of funds checks.

The operator also allowed an individual to transfer significant levels of funds between accounts without scrutiny or conducting source of funds checks. The UKGC states that the firm failed to identify and interact with customers at risk of experiencing gambling-related harm.

As a result, Smarkets will pay the six-figure sum and has received a formal warning. The operator will also undergo an audit to ensure it’s effectively implementing its anti-money laundering and social responsibility policies, procedures, and controls.

Sarah Gardner, the Commission Deputy CEO, said in a statement: “This case was identified through compliance checks and once again highlights how we will take action against gambling operators who fail their customers.

“Our investigation into Smarkets unearthed a variety of failures where customers were put at risk of gambling harm.”

She added: “It was obvious that poor systems and processes were in place which contributed to these breaches, driven by the company’s failure to effectively implement its policies and controls.”

The news comes after the Gambling Commission fined LeoVegas £1.32 million for similar failings and after the regulatory group suspended Bet-at-home.com’s operating licence.